NVIDIA Q2 Fiscal 2026 Performance Overview

NVIDIA has once again delivered impressive results for the second quarter of fiscal 2026, reporting a record revenue of $46.7 billion, a 6% increase from Q1 and a remarkable 56% year-over-year growth. The driving force behind this surge was the company’s data center segment, which generated $41.1 billion, reflecting the growing global demand for advanced AI infrastructure.

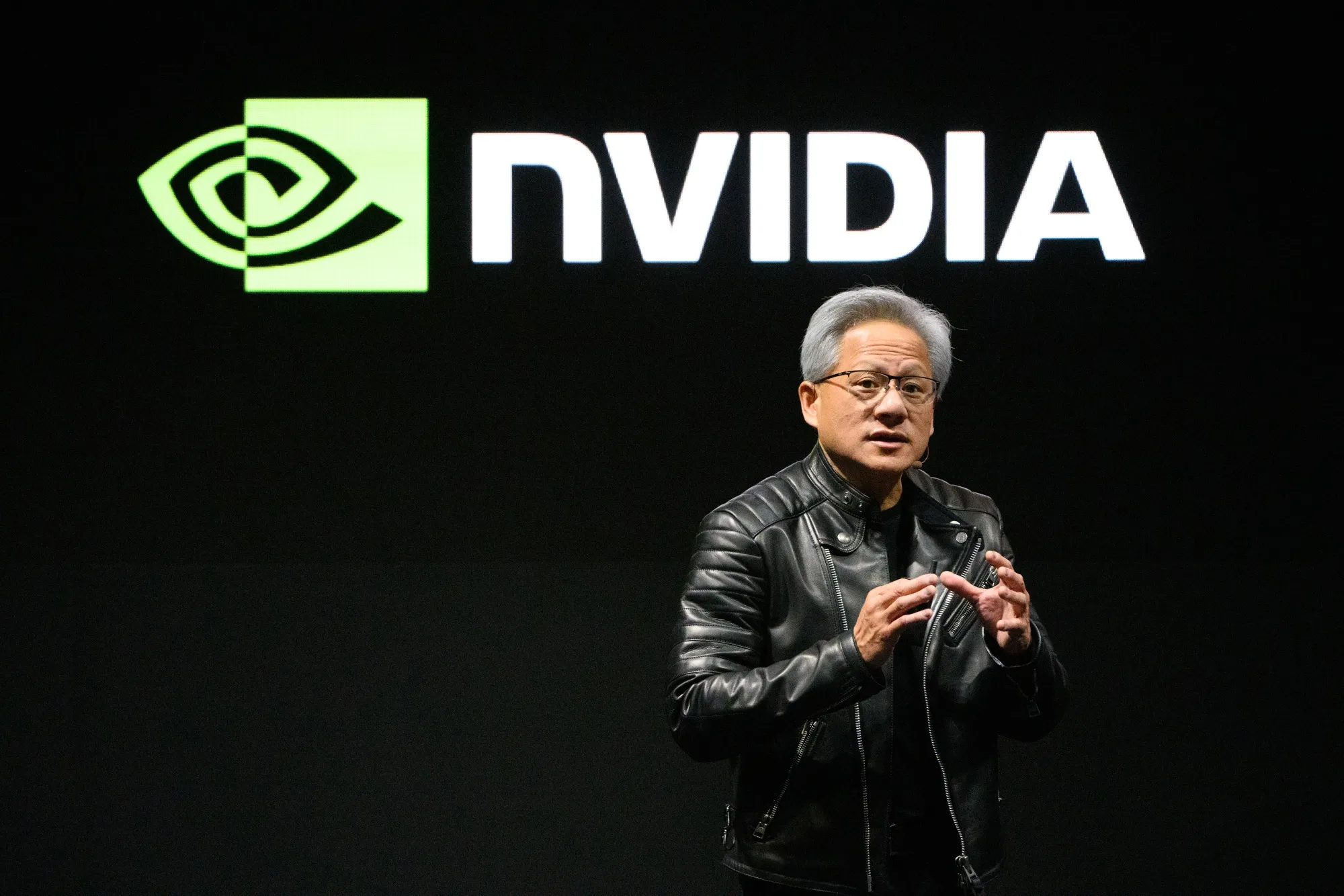

The highlight of the quarter was the Blackwell Data Center platform, which saw sequential revenue growth of 17%. According to CEO Jensen Huang, Blackwell has become the core AI platform powering breakthroughs across industries, making NVIDIA the undisputed leader in the AI race.

Financial Highlights at a Glance

Photo credit :- bloomberg

Here’s a comparison of NVIDIA’s performance over the past quarters:

| Metric | Q2 FY26 | Q1 FY26 | Q2 FY25 | Growth (YoY) | Growth (QoQ) |

|---|---|---|---|---|---|

| Revenue | $46.7B | $44.0B | $30.0B | +56% | +6% |

| Gross Margin (GAAP) | 72.4% | 60.5% | 75.1% | -2.7 pts | +11.9 pts |

| Operating Income | $28.4B | $21.6B | $18.6B | +53% | +31% |

| Net Income | $26.4B | $18.8B | $16.6B | +59% | +41% |

| Diluted EPS | $1.08 | $0.76 | $0.67 | +61% | +42% |

These results highlight NVIDIA’s ability to consistently grow its earnings while maintaining strong margins, even with fluctuations such as the H20 inventory release.

Segment Growth and Business Highlights

- Data Center: Revenue reached $41.1B, fueled by global partnerships and AI adoption across industries.

- Gaming: Posted $4.3B in revenue, up 49% year-over-year, with strong momentum from the launch of GeForce RTX 5060.

- Professional Visualization: Generated $601M, up 32% year-over-year.

- Automotive and Robotics: Delivered $586M in revenue, marking 69% growth compared to last year.

NVIDIA also returned $24.3 billion to shareholders in the first half of fiscal 2026 through buybacks and dividends, showing a strong commitment to investors.

Outlook for Q3 Fiscal 2026

For the upcoming quarter, NVIDIA expects revenue to reach $54 billion, plus or minus 2%. The company projects gross margins around 73.5% and operating expenses near $5.9 billion under GAAP. With continued momentum from AI adoption and Blackwell platform demand, the outlook remains highly positive.

Conclusion

NVIDIA’s Q2 fiscal 2026 results show more than just financial success — they reflect the company’s central role in shaping the AI-driven future. With its Blackwell AI platform, expanding partnerships across industries, and strong revenue growth across segments, NVIDIA has reinforced its position as the leading force in accelerated computing.

For businesses, developers, and investors, the message is clear: NVIDIA is not just keeping pace with the AI revolution — it is leading it.